Kanopi offered microsavings accounts to the unbanked of Indonesia

Product

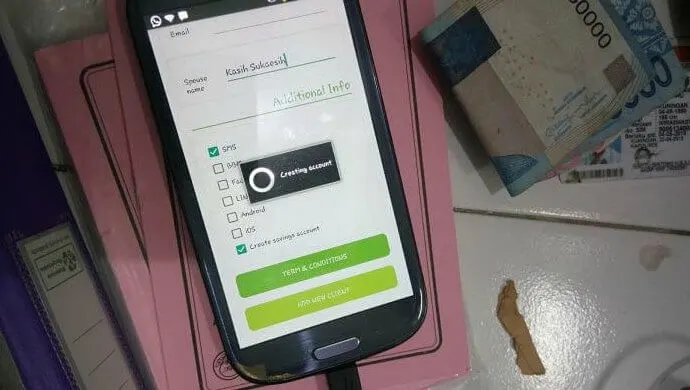

After extensive user research, Kanopi developed a microsavings program. There were several innovations included in the program:

- Prize-linked savings accounts

- Village-based tellers

- Mobile, biometric systems to record transactions

Photos

Result

INACTIVE

Due to personal matters, the founding team needed to leave Indonesia. The mission of helping unbanked Indonesians is carried on by Kuelap and Mifos.

Technology tested

- Mobile devices: Android, USB OTG

- Banking platforms: Mifos

- Low-bandwidth, fault-tolerant communication: HTTPS Basic Auth, RESTful interfaces

- Chatbots: Slack

Press

Article from e27.co:

A 2014 study by the World Bank revealed that only 36 per cent of adults (15-year-old and above) in Indonesia had a bank account, which indicated that a large chunk of people still used hard cash to save (assuming they save money).

According to Indonesia-based microfinance tech startup Kanopi, the country’s low financial inclusion level is due to a variety of product design flaws made by the big banks, that leads to an inadequate product-market fit for most microfinance and payment solutions.

Meanwhile, in this severely unbanked society, microfinance institutes (MFIs) play a crucial role in reaching out to over 50 million people through a range of commercial banks and over 60,000 MFIs. MFIs usually offer loans to members, while some other offer insurance, deposit, and many other financial services.

Unfortunately, many of these MFIs still rely on paper-based solutions or at least Microsoft Excel sheets, making it hard for them to provide fast and efficient services to their clients.

This is where Kanopi comes in. It provides software, hardware and training to help MFIs reach new clients in Indonesia. Using Android-based devices, the startup aims to simplify account monitoring and transaction process, with a back-end system that allows centralised and real-time data storing.

The system also uses fingerprint sensors as a verification method; customers do not need to use passbooks, account numbers, or even passwords that can easily be forgotten. They will also receive SMS notification for every successful transaction.

The startup claims that it has implemented a successful pilot project in Bendungan Hilir, Central Jakarta.

“Even though there are several banks nearby, most local communities don’t use them. Yet, after a two-month Kanopi pilot, our participants had saved on average IDR500,000 (US$38) and were making deposits [of] more than 2.5 times a month on average,” Kanopi CEO and Co-founder Steven Hodgson said in an official statement.

Kanopi was founded by couple Steven and Stephanie. Having lived in Indonesia and fallen in love with the people and culture, they have always been looking for ways to give back to the society.

They were also looking forward to pursuing their passion in social development.

“Our journey to Kanopi started with a simple idea: prize-linked saving accounts. This is where people save money and have a chance of winning a prize. We saw that this concept had been successful in other markets, amongst low-income and unbanked populations, for example in South Africa. We were inspired to explore this concept for the Indonesian market to help encourage people to save money,” Stephanie explains in an e-mail to e27.

Steven, who strongly believed that savings will help eradicate poverty, quit his job at McKinsey & Co. Stephanie also left her job as a physiotherapist. The couple then came to Jakarta and realised the poor were facing many problems regarding access to financial services.

“Since being in Indonesia and meeting with many microfinance institutions, we realised that before we can improve the savings habits of individuals, we need to improve the technology capabilities of the financial institutions themselves,” Stephanie says.

After successful implementation of the pilot project in Jakarta, Kanopi plans to introduce the technology to other areas in Java, Sumatra, and Celebes.

“In 2016, our agenda is to serve the microfinance institutions of Indonesia – bring them excellent technology to manage their accounts and reach more people with their services. From here, we will be able to introduce the institutions to additional products that promote financial inclusion,” she further explains.

Run by a team of six, Kanopi has been bootstrapped so far. While it is not actively looking for funding yet, the co-founders express their willingness to discuss with investors who are interested in “supporting real social business.”

“We have always felt it is important to prove our concept and build something before seeking funding,” Stephanie says. A 2014 study by the World Bank revealed that only 36 per cent of adults (15-year-old and above) in Indonesia had a bank account, which indicated that a large chunk of people still used hard cash to save (assuming they save money).

According to Indonesia-based microfinance tech startup Kanopi, the country’s low financial inclusion level is due to a variety of product design flaws made by the big banks, that leads to an inadequate product-market fit for most microfinance and payment solutions.

Meanwhile, in this severely unbanked society, microfinance institutes (MFIs) play a crucial role in reaching out to over 50 million people through a range of commercial banks and over 60,000 MFIs. MFIs usually offer loans to members, while some other offer insurance, deposit, and many other financial services.

Unfortunately, many of these MFIs still rely on paper-based solutions or at least Microsoft Excel sheets, making it hard for them to provide fast and efficient services to their clients.

This is where Kanopi comes in. It provides software, hardware and training to help MFIs reach new clients in Indonesia. Using Android-based devices, the startup aims to simplify account monitoring and transaction process, with a back-end system that allows centralised and real-time data storing.

The system also uses fingerprint sensors as a verification method; customers do not need to use passbooks, account numbers, or even passwords that can easily be forgotten. They will also receive SMS notification for every successful transaction.

The startup claims that it has implemented a successful pilot project in Bendungan Hilir, Central Jakarta.

“Even though there are several banks nearby, most local communities don’t use them. Yet, after a two-month Kanopi pilot, our participants had saved on average IDR500,000 (US$38) and were making deposits [of] more than 2.5 times a month on average,” Kanopi CEO and Co-founder Steven Hodgson said in an official statement.

Kanopi was founded by couple Steven and Stephanie. Having lived in Indonesia and fallen in love with the people and culture, they have always been looking for ways to give back to the society.

They were also looking forward to pursuing their passion in social development.

“Our journey to Kanopi started with a simple idea: prize-linked saving accounts. This is where people save money and have a chance of winning a prize. We saw that this concept had been successful in other markets, amongst low-income and unbanked populations, for example in South Africa. We were inspired to explore this concept for the Indonesian market to help encourage people to save money,” Stephanie explains in an e-mail to e27.

Steven, who strongly believed that savings will help eradicate poverty, quit his job at McKinsey & Co. Stephanie also left her job as a physiotherapist. The couple then came to Jakarta and realised the poor were facing many problems regarding access to financial services.

“Since being in Indonesia and meeting with many microfinance institutions, we realised that before we can improve the savings habits of individuals, we need to improve the technology capabilities of the financial institutions themselves,” Stephanie says.

After successful implementation of the pilot project in Jakarta, Kanopi plans to introduce the technology to other areas in Java, Sumatra, and Celebes.

“In 2016, our agenda is to serve the microfinance institutions of Indonesia – bring them excellent technology to manage their accounts and reach more people with their services. From here, we will be able to introduce the institutions to additional products that promote financial inclusion,” she further explains.

Run by a team of six, Kanopi has been bootstrapped so far. While it is not actively looking for funding yet, the co-founders express their willingness to discuss with investors who are interested in “supporting real social business.”

“We have always felt it is important to prove our concept and build something before seeking funding,” Stephanie says.